2007年VOA标准英语-US Central Bank Chief Faces Senate Questions on(在线收听)

Washington

19 July 2007

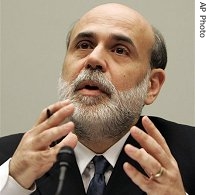

Federal Reserve Board Chairman Ben Bernanke spoke to a Senate committee Thursday about conditions in the U.S. housing market. VOA's Barry Wood reports the chairman of America's central bank faced tough questioning from the senators about the difficulties poorer Americans are having paying their home loans.

|

| Federal Reserve Reserve Board Chairman Ben Bernanke testifies before the House Financial Services Committee on Capitol Hill in Washington, 18 Jul 2007 |

"So we have not yet seen anything, except in a few local areas, akin to a decline in house prices. We have not yet seen a decline in [overall] consumption [by consumers]," he said.

Bernanke told the senators that the losses from bad home loans, loans that borrowers are unable to repay, could reach $100 billion this year. These losses are being borne by financial institutions and not by the government.

Senator Jim Bunning, from Kentucky, had little sympathy for the companies that loan money to homebuyers. He said many of them lure buyers into purchasing house they cannot afford. "Instead of buying a $400,000 home, it should have been a [$]200,000 home. Instead of an interest-free loan, it should have been a 30-year mortgage," he said.

Senator Robert Menendez, from New Jersey, said many households cannot afford to pay their home loans because they are so deep in debt.

"The average family in America is in debt for over $130 for every $100 it has to spend. And compounding this is that the average household savings rate has actually been negative for the past seven quarters [21 months], averaging a negative one percent for 2006," he said.

Responding to the senators, Bernanke agreed that poorer Americans are being financially squeezed and don't have needed savings. He suggested that the Federal Reserve might undertake a program of public education about the need to save.

"The fact is that the bottom third of our population has almost no savings, maybe less than $500. I think this is a very serious problem. We need to find ways to make people more cognizant of the need to save, to help them to save, so they can build wealth and will have more security in case they have, for example, an illness or an unemployment spell," he said.

Debt has become a problem for many Americans. Recent figures say that most households have credit card debt that exceeds $8,000.