VOA标准英语10月-US Moves to Strengthen Banks as Markets Rally(在线收听)

|

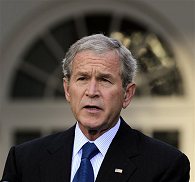

| President Bush delivers remarks on the economy in the Rose Garden of the White House in Washington, Tuesday, 14 Oct. 2008 |

Speaking before the opening of U.S. financial markets, President Bush detailed an unprecedented plan of direct government involvement in private banks. He said the federal government will inject capital into banks by purchasing some of their stock.

"This new capital will help healthy banks continue making loans to businesses and consumers," Mr. Bush said. "And this new capital will help struggling banks fill the hole created by losses during the financial crisis, so they can resume lending and help spur job creation and economic growth."

In addition, the president said the federal government will guarantee most new loans issued by insured banks, including short-term loans between banks. And, the government will take additional steps to make it easier for businesses to cover day-to-day operations.

The president stressed that the steps being taken are temporary, and are, in his words, "not intended to take over the free market, but to preserve it." The funds to be spent will come from the $700 billion rescue package Mr. Bush signed into law earlier this month. The new measures mirror several components of a European plan announced Sunday.

Meanwhile, the global market rebound continues. Building on Monday's breathtaking gains, shares in Tokyo finished up more than 14 percent. Major European markets had gained between five and seven percent in afternoon trading