voa标准英语2008年-Another Down Day for World Markets(在线收听)

Last month, the U.S. Congress approved a $700 billion rescue package to save financial firms hit hard by a rash of home foreclosures. The goal was to unfreeze tight credit and lessen the severity of an economic downturn that has spread across the globe.

At the time, the U.S. Treasury said a significant portion of the funds would be used to purchase so-called "troubled assets" - bad debt stemming from mortgages defaulted on by borrowers. With debt burdens lifted, it was hoped that banks and other financial institutions would be strengthened, and the credit crunch would ease.

Now the plan has changed. Treasury Secretary Henry Paulson spoke at a news conference on Wednesday.

|

| Henry Paulson |

"Over these past weeks, we have continued to examine the relative benefits of purchasing illiquid mortgage-related assets," he said. "Our assessment at this time is that this is not the most effective way to use [government bailout] funds. But we will continue to examine whether targeted forms of asset purchase can play a useful role in helping to strengthen our financial system and support lending."

The Bush administration has embarked on an unprecedented program of direct government investment in banks through stock purchases - effectively partially nationalizing America's banking system. Governments in Europe and elsewhere have taken similar steps in recent weeks.

Treasury Secretary Paulson also spoke of his intention to boost institutions that provide consumer credit in the form of credit cards as well as student and automobile loans.

Tight credit conditions have added to the woes of U.S. carmakers, as some consumers have been unable to get loans to purchase vehicles. But U.S. automakers were ailing even before the financial crisis struck, losing market share to foreign brands that provide more choices for fuel-efficient vehicles. In addition, American carmakers have been saddled with hefty costs stemming from pensions for retired employees and pricey health insurance premiums for its workforce.

|

| General Motors CEO Rick Wagoner at a news conference in Detroit with company Product Development Vice Chairman Bob Lutz, right. 07 Nov, 2008 |

After years of steep losses, the top-three U.S. automakers - General Motors, Ford and Chrysler - say they could face bankruptcy in coming months. Such an outcome is unthinkable, according to Governor Jennifer Granholm of Michigan, where the America's automobile industry is headquartered.

"This industry supports one-in-ten jobs in the country. If this industry is allowed to fail, there will be a ripple effect throughout the nation," said Granholm.

Democratic Congressional leaders are pressing for an emergency $25 billion loan to automakers as part of the $700 billion financial rescue package.

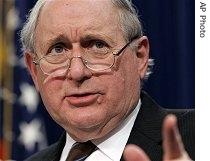

Michigan Senator Carl Levin says the amount being discussed is tiny compared to the funds spent to prop up the country's largest insurance firm, American International Group, or AIG.

|

| Senator Carl Levin, 07 Dec 2007 |

"One hundred-fifty billion dollars has gone to one insurance giant - AIG. Twenty-five billion dollars in a direct bridge loan to the auto industry, given its unique central role in this economy, does not seem at all out of line [i.e., unreasonable]," said Levin.

But skeptics argue that such an infusion of government funds would only postpone bankruptcy without addressing the underlying causes of the decline in American car manufacturing. They point out that several U.S. airlines have gone through bankruptcy and reorganization and emerged stronger for having done so.